are electric cars tax deductible uk

If the car is a hybrid. This means with electric cars you can deduct.

Victoria S Electric Vehicle Tax And The Theory Of The Second Best

Or car is electric First year allowances.

. Buying a car through your business example. You can claim for the capital cost of buying the vehicle as well as for other running costs such as insurance and repairs. The BiK rate will rise to.

The exception is for cars registered after 1st April 2017 that cost over 40000. As a higher rate taxpayer you buy a 50k VAT car through your business and you will be using it 5050 for business and personal. If your company car has CO2 emissions of 1 to 50gkm the value of the car is based on its zero emission mileage figure or electric range.

Capital allowances on electric cars. According to new vehicle tax rates pure electric cars with no tail emissions will not pay road tax. The Tax Benefits Of Electric Vehicles Saffery Champness According to new vehicle tax rates pure electric cars.

You lease an electric car for 6000 over the 2022-23 financial year. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car. Are electric cars 100 tax deductible UK.

You can also check if your employee is eligible for tax relief. This is the distance the car can go on electric. Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances.

Are electric cars tax deductible uk Monday July 4 2022 Edit. You deduct the cost against profits. Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances.

Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year. However there have been significant reductions in this charge from April 2020. Claim capital allowances so your business pays less tax when you buy assets.

For example a vehicle costing 36000 with CO2 levels of 32 gkm and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021-22 and be. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. Are electric cars tax deductible UK.

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. By Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. Yes electric car subscriptions are tax deductible in the UK.

As corporation tax is 19 then your tax savings are calculated as 19. For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels. This charge is deductible for corporation tax purposes.

Fully electric vehicles can still create substantial savings for both employees and employers when taken via salary. Are electric cars fully tax deductible UK. This means with electric cars you can deduct the full.

As with car tax and company car tax the rate at which. Electric car capital allowances Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. This means with electric cars.

New and unused CO2 emissions are 50gkm or less or car is. Are electric cars fully tax deductible UK.

Company Car Tax Incentives For Electric Hybrid Vehicles Stewart Co

Everything You Need To Know About The New Ev Tax Credit And How To Get It Tom S Guide

A Complete Guide To Ev Ev Charging Incentives In The Uk

What S An Electric Car Really Like To Live With Pros And Cons Revealed Car Magazine

How Much Is The Benefit In Kind Company Car Tax On An Electric Car Drivingelectric

Why Labor S New Tax Cut On Electric Vehicles Won T Help You Buy One Anytime Soon

Could You Live With An Electric Car The Pros And Cons Of Owning An Ev Today Auto Express

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

The Tax Benefits Of Electric Vehicles Saffery Champness

Were These Electric Cars Abandoned Because Their Batteries Failed Snopes Com

What S An Electric Car Really Like To Live With Pros And Cons Revealed Car Magazine

What Are The Tax Benefits Of Having An Electric Vehicle

Should I Buy An Electric Car Through My Business Tax Implications

Federal Tax Breaks Provide Incentives To Buy Electric Vehicles Wlos

Electric Vehicles What S Behind Their Declining Resale Values

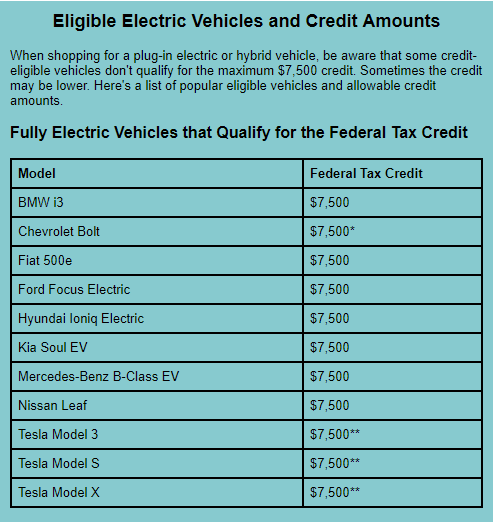

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Thinking Of Buying An Electric Car In The Uk Read This First Wired Uk